Content

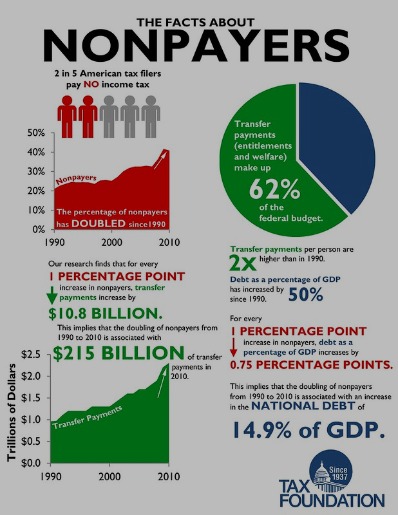

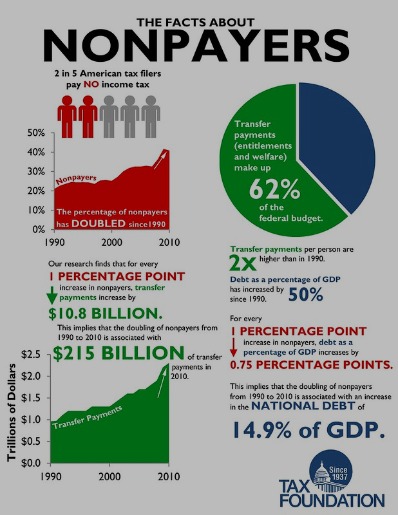

Passive activity loss rules are a set of tax regulations that prohibit the use of passive losses to offset taxable earned or ordinary income. Rental property owners may assume that anything they do on their property is a deductible expense. While depreciation saves you money now, the IRS might want some of that money back. If you depreciate property and then sell it for more than its depreciated value, you’ll owe depreciation recapture taxes on the gain.

I think he said the magic number we would have been able to claim without the “Real estate professional” that was around 30k. Can I purchase a Porsche new, or old; , and write off a portion of the purchase of the car, since Tax Deductions For Owner I use it to manage my properties? I’ve been told that you can also expense items based upon policy and dollar value. For example, my CPA was telling me I had to depreciate a $900 hot water heater over 27.5 years.

Meal Expenses

As a rental property owner, you can deduct various expenses related to buying, operating, and maintaining the property. Truck drivers are required to get regular DOT medical fitness exams in order to maintain their CDL. You can deduct the cost of these exams as a business expense. Any medical exams or treatments that are not directly work-related are only deductible as personal expenses, not business, and you can only claim them if you itemize your deductions.

- Homeowners who itemize deductions may reduce their taxable income by deducting interest paid on a home mortgage.

- But be prepared to back up your claim and separate costs for repairs and maintenance from those that are capital improvements.

- A necessary expense is defined as an expense that is “helpful and appropriate” for your trade or business.

- What does this mean for high-tax states like New York, New Jersey or Connecticut?

- Investors can easily stipulate which fees they may be by using afree rental agreement template.

- SmartAsset’sbudget calculatormakes it extremely easy to get a plan ready to go.

According to the IRS website, 15.3% is the self-employment tax rate. Since you are an owner operator truck driver, you are the one that’s responsible for organizing and paying your taxes. And there are a few types of taxes you need to take into consideration. Keep in mind, if you use a landline at home, you cannot deduct the cost of your first line, even if you use it solely for work. However, if you have a second landline devoted to the business, the cost of that line is deductible.

Property taxes

The tax code provides several benefits for people who own their homes. The main benefit is that the owners do not pay taxes on the imputed rental income from their own homes. They do not have to count the rental value of their homes as taxable income, even though that value is just as much a return on investment as are stock dividends or interest on a savings account. If the loan or credit card was used to buy, maintain or repair something at a rental property, they can deduct interest. Property owners should be careful not to mix business expenses with personal ones. The Section 179 deduction allows business owners to deduct up to $1,080,000 of property placed in service during the tax year.

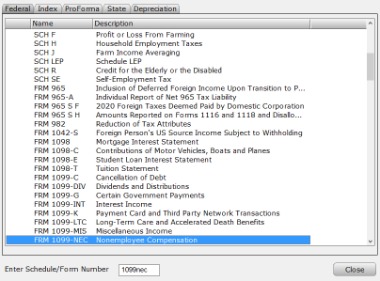

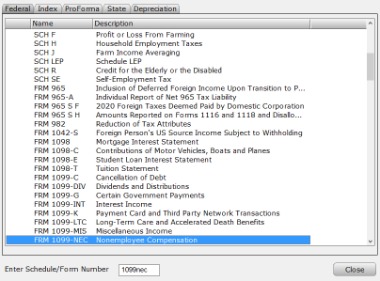

As an owner operator, one of the biggest challenges of operating a trucking business is understanding how taxes work. If you have more than three rental properties, complete and attach as many Schedules E as are needed to list the properties. Complete lines 1 and 2 for each property, including the street address for each property. However, fill in the “Totals” column on only one Schedule E. The figures in the “Totals” column on that Schedule E should be the combined totals of all Schedules E. Find out tax rules that apply to landlords who hire independent contractors to help them with their rental business, see Hiring Independent Contractors for Your Rental Activity.

bonus depreciation vs. section 179 write-offs in real estate investing

My tax bill was definitely lower this year as a landlord, with the Tax Cuts and Jobs Act. One of the best parts of being a landlord is deducting all rental expenses separately and still being able to take the standard deduction. If you own rental property in an area that charges an occupancy-like tax, then the amount is tax deductible. Remember, however, that the tax will not only differ from state to state but also from local jurisdictions like cities and counties. The Tax Cuts and Jobs Act trimmed this important tax break for homeowners.

There are certain things that you can do throughout the year to help prepare you for when tax time comes around. Keeping accurate records of actual expenses can be a time-saving friend as an owner operator truck driver. Our friends at Gusto put together a handy list of store deductions and startup tax deductions. Have your team of dedicated bookkeepers at Bench track all of the expenses related to running your business to ensure you’re taking advantage of every legitimate deduction.

Part-year residents should complete the computation using only the deductions paid for while Virginia residents. To deduct moving expenses, you must complete Form IT-225, New York State Modifications. For more information, see the instructions for Form IT-225. Your property assessment is one of the factors used to calculate your property tax bill. The assessor lists all of the assessments on the assessment roll. To be eligible, your home must be your primary residence, and your total household income can’t exceed $500,000.

However, such landlords can avoid this limit by agreeing to depreciate their rental property over 30 years instead of 27.5 years. While investors generally want their properties to make as much money as possible, if you incur https://quick-bookkeeping.net/am-i-insolvent-the-signs-of-insolvency-for-small/ losses on a commercial real estate investment, you may be able to take them as a tax deduction. In general, there are three different taxpayer classifications when it comes to rental losses from commercial real estate.

You can deduct these fees as operating expenses as long as the fees are paid for work related to your rental activity. Such personal property includes appliances or furniture in rental units and gardening equipment. If you are a homeowner, then you should take some time to explore your tax deductions. If you need help tackling the details of your situation, it’s recommended to speak to a tax professional to ensure that you are cashing in on all the tax deductions available to you. With the standard deduction, you can reduce your taxable income by a standard amount.

- As a result, they don’t claim the full amount of deduction they’re eligible for, so pay more tax than they should.

- The amount you can deduct depends on the type of plan you have.

- Likewise, for internet bills, phone service charges and the like, with the caveat that you need to be able to document that it was forbusiness purposes.

- With all this in mind, it’s important that commercial real estate investors consult with an experienced tax professional in order to better understand how each of these tax benefits may be able to work for them.

- Under the Tax Cuts and Jobs Act, landlords can still deduct rental property taxes as an expense.

Accelerated depreciation allows investors to write off the cost of their investment over a shorter period of time than the asset’s useful life. Mortgage interest deductions allow investors to deduct any interest they pay on a commercial mortgage off of their federal income taxes. Lastly, tax advantages for an investor’s heirs can lead to a massive difference in returns, especially over an extended period of time.

With that deal, you would walk away with a capital gain of $50,000. The IRS has extensive rules about the tax breaks available for homeowners. Let’s dive into the tax breaks you should consider as a homeowner. For heads of households, the standard deduction is $18,800.

That gives you flexibility in the items that you can deduct. But be prepared to back up your claim and separate costs for repairs and maintenance from those that are capital improvements. Remember, the money you spend on improvements could reduce your tax liability when you sell. If you materially participated as a real estate professional, your rental property involvement will receive non-passive tax treatment.