Content

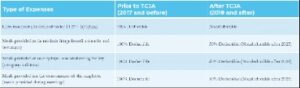

You won’t find your adjusted gross income on your W-2 form, but it contains some of the information that you need to fill out Form 1040 and calculate your AGI. Specifically, Box 1 of your W-2 shows your total “wages, tips, and other compensation,” which is your total taxable income from that employer. Adjusted gross income is your total annual income minus certain deductions, like contributions to a health savings account and 401 retirement plan. Keep reading to learn how to calculate adjusted gross income and where to use it when filing your state and federal tax return. A simple tax return is one that’s filed using IRS Form 1040 only, without having to attach any forms or schedules. This is an optional tax refund-related loan from Pathward, N.A.; it is not your tax refund.

Securities offered by Investment Distributors, Inc. the principal underwriter for registered products issued by PLICO and PLAIC, its affiliates. You cannot use the same investment for a Qualified Equity or Tax Formula To Determine Adusted Gross Income And Taxable Income From Gross Income Subordinated Debt Credit, or a subtraction for long-term capital gains. Investments do not qualify if they were made in a company owned or operated by an affiliate or a family member of the taxpayer.

Adjusted gross income is simply all the money you made for a year minus special adjustments the IRS allows to help lower taxes.

Payments from non-compete clauses/covenants not to compete, which pay over a number of years. Later payments are Massachusetts source income if the original clause was based on your Massachusetts activity. Understanding the definition of gross income can be important because gross income is the starting point for calculating many other types of https://kelleysbookkeeping.com/ income. Is a business technology writer and researcher whose work focuses on financial services and cross-cultural diversity and inclusion. Your AGI will never be more than your total income, and it’s not uncommon for your AGI and total income to be the same. On line 10, fill in your total adjustments to income from line 26 of Schedule 1 .

Help us continue our work by making a tax-deductible gift today. We’ll be in your inbox every morning Monday-Saturday with all the day’s top business news, inspiring stories, best advice and exclusive reporting from Entrepreneur. AGI is a substantial number to understand when it comes to taxes.

Adjusted gross income, or AGI, is an important concept for taxpayers to know.

Your presence for business in Massachusetts is casual, isolated, and inconsequential if it meets the Ancillary Activity Test requirements. Massachusetts source income received by a nonresident who is a citizen of a foreign country. All other types of income that fall within the definition of Massachusetts source income. Income from selling or exchanging patents, copyrights, designs, ideas or other similar intangible, if gained from or connected with a trade or business in Massachusetts. Royalties from licensing a patent or copyright, and income from licensing a design, idea or other similar intangible to a person for use or production in Massachusetts.

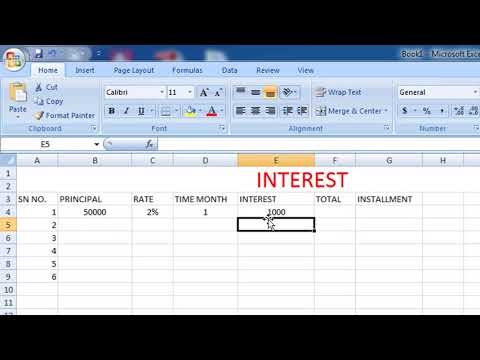

How do you determine your adjusted gross income and taxable income?

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

A self-employed person is an independent contractor or sole proprietor who reports income earned from self-employment. You can adjust your income if you are a qualified artist, as well as a reservist and some fee-basis government officials. Qualified educator expense deductions are capped at $300.

1 Form 1040, IRS

You are required to meet government requirements to receive your ITIN. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. Unless you have the time and aptitude to follow the IRS instructions and conduct any necessary research, it might be more practical to use the services of an experienced tax professional. While hiring a tax professional may cost you more, it may be well worth it considering the time saved and frustration prevented from trying to figure out the rules on your own. To arrive at your final AGI, you are allowed to subtract certain amounts from your total income.

- “The line,” in this case, is your adjusted gross income.

- The IRS uses the AGI to determine how much income tax you owe.

- If your itemized deductions totaled are less than the standard deduction, take the standard deduction.

- See your Cardholder Agreement for details on all ATM fees.

- A number of US states use the adjusted gross income to determine whether state-specific credits or deductions are applicable.

To e-file your federal tax return, you must verify your identity with your AGI or your self-select PIN from your 2021 tax return. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. Sometimes when people ask about annual income, they may be thinking of their salary before or after taxes are taken out from their paychecks.

Once these “above-the-line” deductions are accounted for, the taxpayer has calculated their AGI. From AGI, the taxpayer then subtracts either the standard or itemized deductions, whichever is larger, and, if applicable, a deduction for any pass-through income. The total after these subtractions is called “taxable income” and is the amount subject to statutory income tax rates. In short, knowing your adjusted gross income on a W-2 form is essential to understanding your taxable income and maximizing tax benefits such as deductions and credits.

- You may also have sources of income that aren’t reported on a W-2, such as income from a rental property that you own.

- A PTE filing Form NRCR on behalf of its participating nonresident members may claim the sum of all PTE credits allocable to the members who have elected to participate in the Nonresident Composite Return.

- To calculate AGI for a new job, you’ll still need to add up all forms of income and then subtract the AGI deductions.

- You are required to meet government requirements to receive your ITIN.

- Subtract allowable deductions and expenses from the sum.

- Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.